Defining a new hospitality opportunity

It’s not about moonshots; it's an organic shift to a new chapter in hospitality's story, we are redefining the narrative of hospitality.

We are early movers in this natural evolution of hospitality, elevating guest satisfaction while targeting twice the profitability of traditional models.

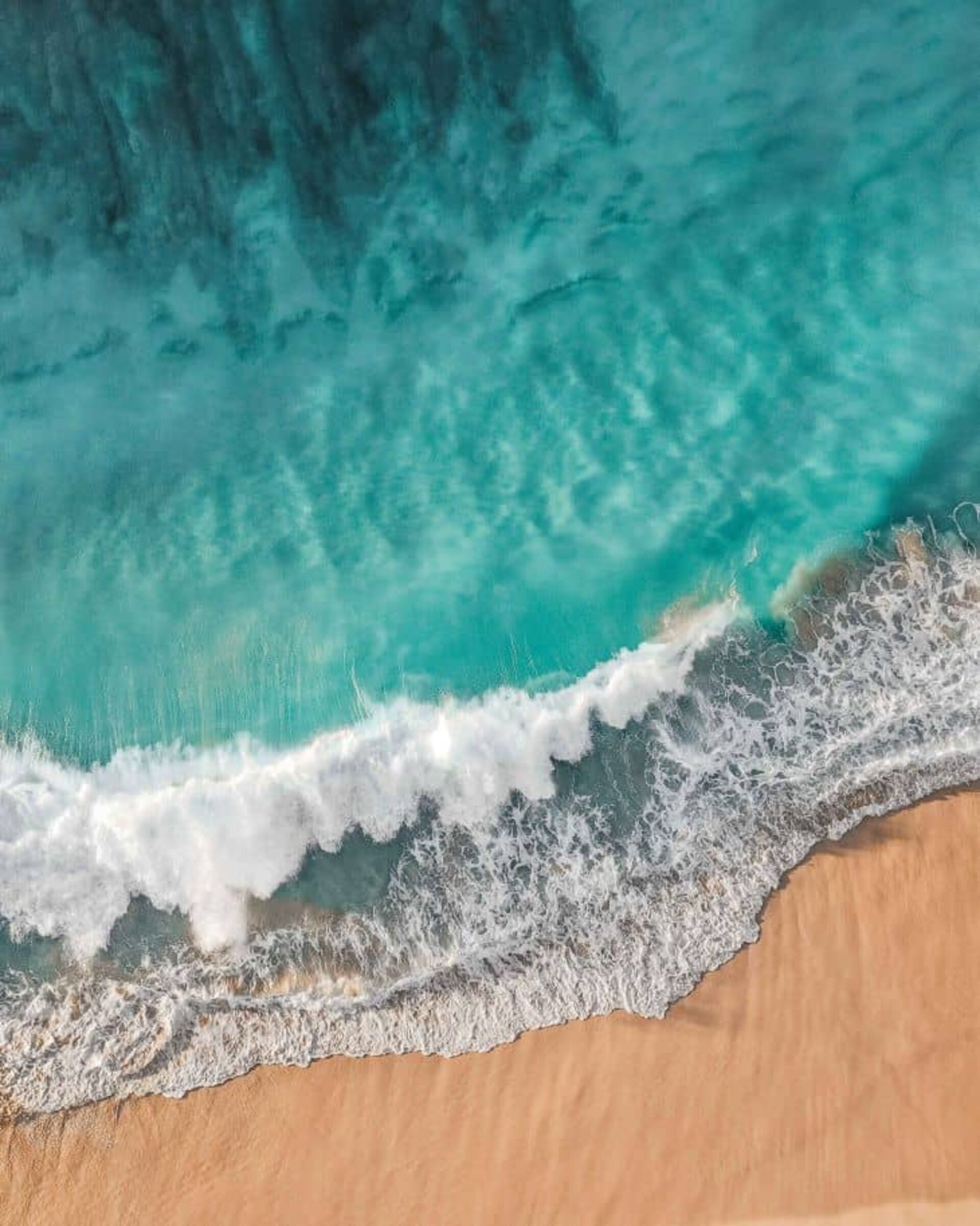

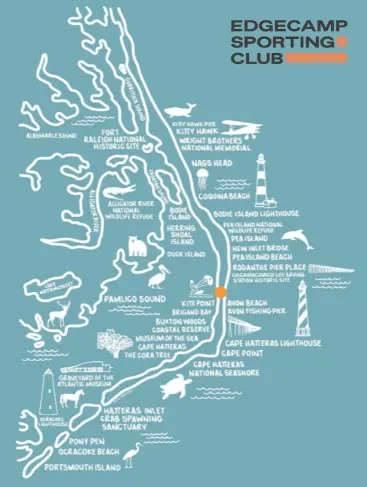

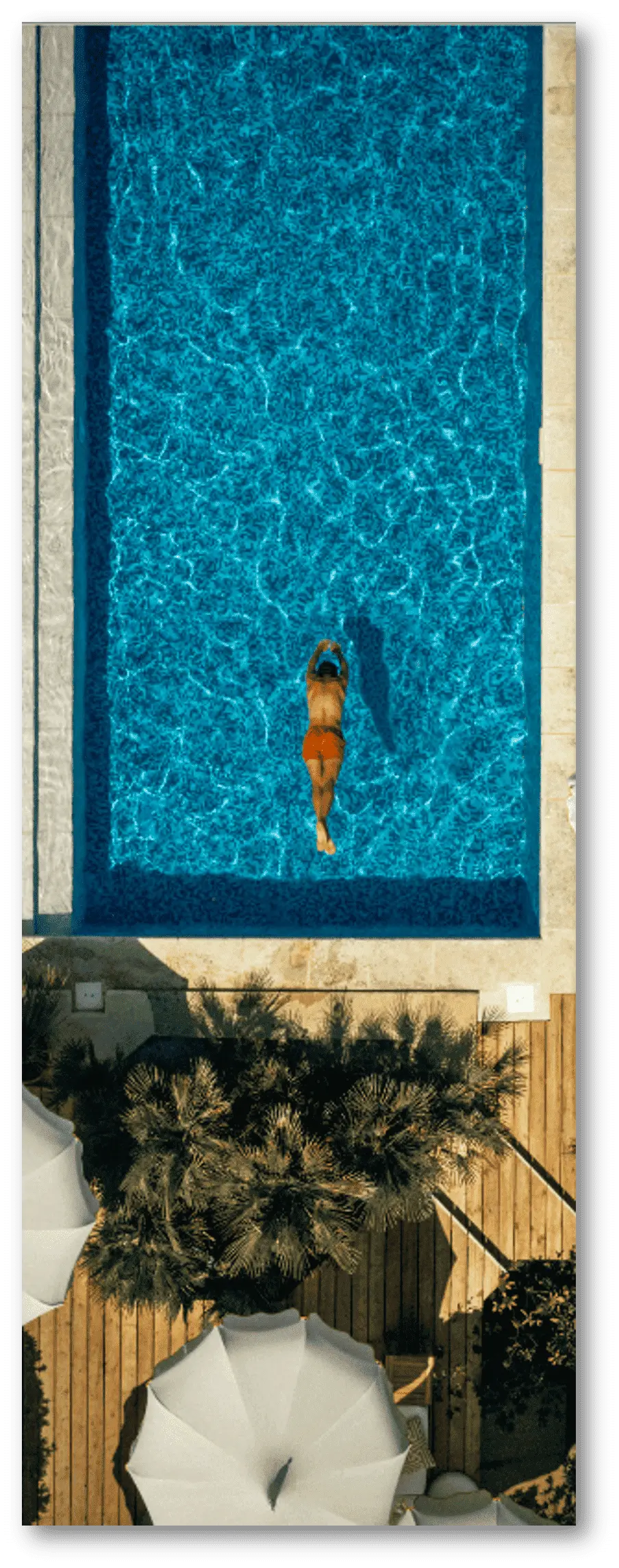

At the convergence of premium hotels and short-term rentals, Stomp owns and is developing a growing collection of master-planned, intelligently designed, a-la-carte amenity-rich destinations.

Where the accomodations feel like they were made with you in mind and you experience delightful light-touch hospitality, otherwise, you're left to enjoy because isn't that what it's all about?

A place that leaves you feeling happy, inspired, connected, recharged, or quite frankly, however you want to feel after vacation. Most importantly, you leave with the distinct feeling of "I can't wait to come back".

We’re building this for ourselves—and for you.

.jpg)